Wegagen Bank S.C., one of Ethiopia’s largest private banks, has issued a prospectus for the registration of its existing shares with the Ethiopian Capital Market Authority (ECMA). This registration is a Listing by Introduction, meaning no new shares are being issued for sale. Instead, the bank is preparing its shares for future trading on the Ethiopian Securities Exchange (ESX).

This report provides a detailed yet digestible analysis of the bank’s financial performance, risk factors, competitive positioning, and strategic outlook, helping investors make informed decisions.

Key Offer Details

- Issuer: Wegagen Bank Share Company

- Number of Shares Registered: 6,218,635

- Par Value Per Share: ETB 1,000.00

- Type of Offer: Share registration (No new issuance/ Listing by Introduction)

- Regulatory Approval: Approved by the Ethiopian Capital Market Authority (ECMA)

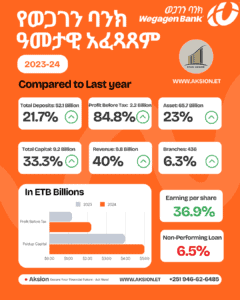

Financial Performance: Strong Growth with Profitability Improvement

Key Financial Indicators (ETB ‘000)

Key Takeaways

✅ Revenue & Profitability: The bank’s profit before tax grew by a staggering 130% over three years, showcasing strong profitability.

✅ Asset Growth: Total assets expanded at a healthy 28% annual growth rate.

✅ Deposit Mobilization: Deposits increased by 26%, indicating growing customer confidence.

✅ Loan Portfolio Expansion: Loans and advances grew at 24%, supporting credit-driven growth.

Competitive Landscape: Positioning in Ethiopia’s Banking Sector

Industry Positioning

Ethiopia’s banking sector has 32 banks, including the dominant Commercial Bank of Ethiopia (CBE) and emerging private banks.

Wegagen’s Market Share (FY 2024):

📈 Deposits: 3.7% of total private sector deposits

📈 Loans & Advances: 4.3% of total industry loans

📈 Total Assets: 4.0% of total private banking assets

📈 Profit Before Tax: 4.2% (showing strong profitability relative to size)

Competitive Strengths

✅ Digital Banking Expansion: Launched digital lending (Efoyta), mobile banking, and international Visa cards.

✅ Diversified Product Portfolio: Offers conventional banking, interest-free banking (IFB), and trade finance.

✅ Geographic Reach: Operates 443 branches nationwide with over 3.6 million customers.

✅ Resilient Growth Strategy: Despite market challenges, Wegagen has consistently outperformed many private banks in profitability.

Challenges

⚠ Slower Deposit Growth: Wegagen’s 19% annual deposit growth is below the industry’s 30% growth.

⚠ Limited Branch Expansion: Industry average branch growth was 19%, while Wegagen expanded at only 3%.

Key Risk Factors for Investors

Investing in Wegagen Bank shares comes with potential risks, including:

- Increased Competition

– Foreign banks entering Ethiopia pose a competitive threat.

– Fintech and microfinance institutions are challenging traditional banking. - Political & Economic Instability

– Ongoing regional conflicts and inflation impact banking operations.

– Political risks could disrupt market confidence and banking sector stability. - Liquidity & Credit Risks

– Loan defaults could increase due to economic challenges.

– High loan-to-deposit ratio (bank’s reliance on deposits for lending) poses liquidity risks. - Foreign Exchange Challenges

– Limited foreign currency reserves impact trade finance and international transactions.

– The floating exchange rate regime increases currency risk. - Cybersecurity & IT Risks

– Increased digital banking adoption raises cybersecurity vulnerabilities.

– IT system failures or fraud could disrupt operations.

Strategic Outlook: Growth Opportunities

Wegagen’s Business Strategy (2021-2026)

✔ Business Growth: Expand market share through customer acquisition and digital banking.

✔ Operational Excellence: Improve efficiency and service quality via automation and streamlined processes.

✔ Digital Transformation: Invest in mobile banking, AI-driven lending, and digital payments.

✔ Capital Market Participation: Plans to establish an investment bank and list shares on ESX for future growth.

Future Opportunities

📈 Capital Market Expansion: With Ethiopia’s stock exchange launching soon, Wegagen aims to raise additional capital and offer new financial products.

📈 Diaspora & Trade Finance: Growing remittances and trade liberalization increase foreign currency inflows.

📈 Interest-Free Banking (IFB) Growth: Demand for Sharia-compliant banking services presents an untapped market.

Final Verdict

✅ Investment Strengths:

- Strong Financial Growth: Profits have grown 130% over three years, outperforming the industry.

- Expanding Digital Banking: Increased fintech adoption positions Wegagen for long-term growth.

- Capital Market Readiness: Listing on the Ethiopian Securities Exchange (ESX) will enhance share liquidity and value.

- Diversified Business Model: Offers retail, corporate, interest-free banking, and trade finance services.

⚠ Risks to Consider:

- Market Competition: Entry of foreign banks and fintech disruptors may reduce market share.

- Political Uncertainty: Regional conflicts and inflation could impact banking operations.

- Liquidity Pressures: Wegagen needs stronger deposit growth to sustain lending expansion.

Closing Thoughts

Wegagen Bank’s decision to register its shares for trading on ESX marks a milestone for Ethiopia’s capital market. With a strong profitability trajectory, expanding digital services, and an investment bank in the pipeline, the bank presents a compelling opportunity for long-term investors.

However, competition, political risks, and liquidity challenges remain key concerns. Investors should monitor macroeconomic conditions and banking sector regulations closely before making an investment decision.

🔍 Stay tuned for more updates on Ethiopia’s financial market trends and capital market developments.

Leave a Reply