As Ethiopia’s banking sector continues to expand, understanding the financial health and efficiency of each institution is essential for investors, business owners, and customers. By analyzing key performance metrics such as Profit Margin, Return on Assets (ROA), Return on Equity (ROE), Asset Turnover Ratio, and Operational Efficiency, we gain a deeper insight into the strengths and weaknesses of various banks.

This article provides an overview of these key metrics, with a focus on the most efficient banks in Ethiopia. Let’s explore how these indicators paint a broader picture of bank performance and efficiency.

Key Financial Metrics: What Do They Mean?

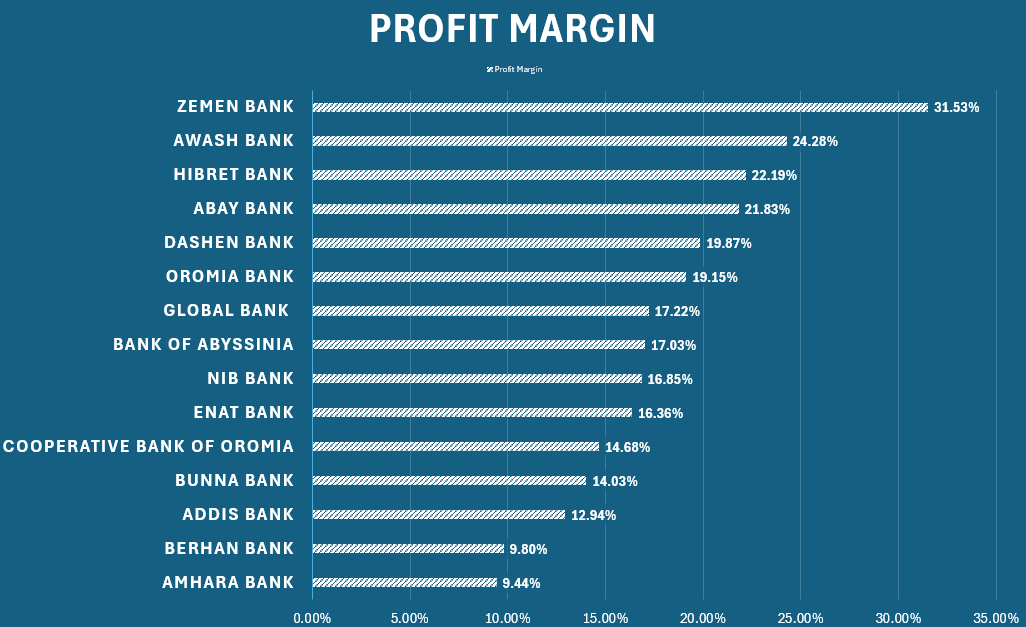

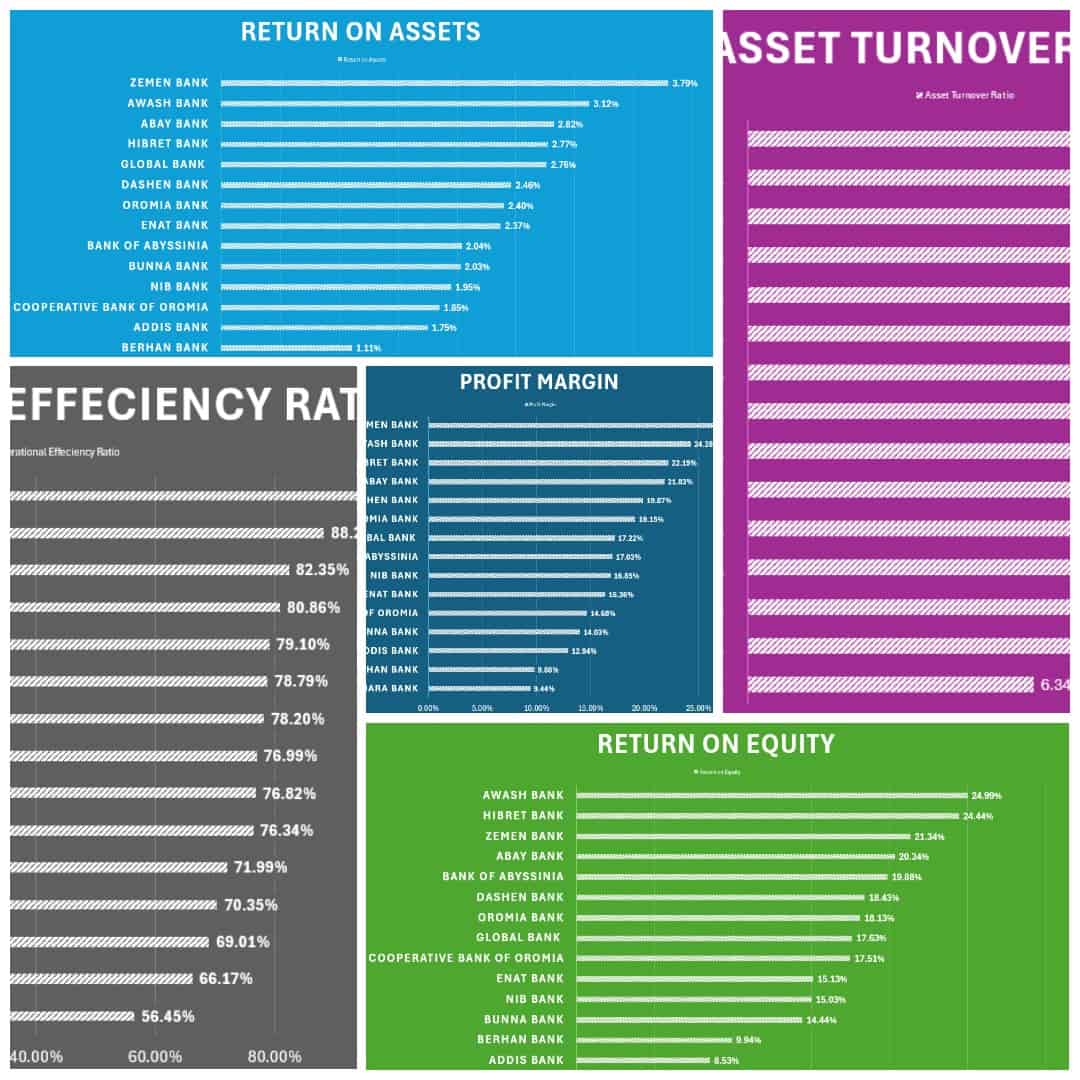

- Profit Margin

Profit Margin measures how much of a company’s revenue is converted into profit after all expenses are deducted. A higher profit margin indicates better cost management and profitability.

Chart:

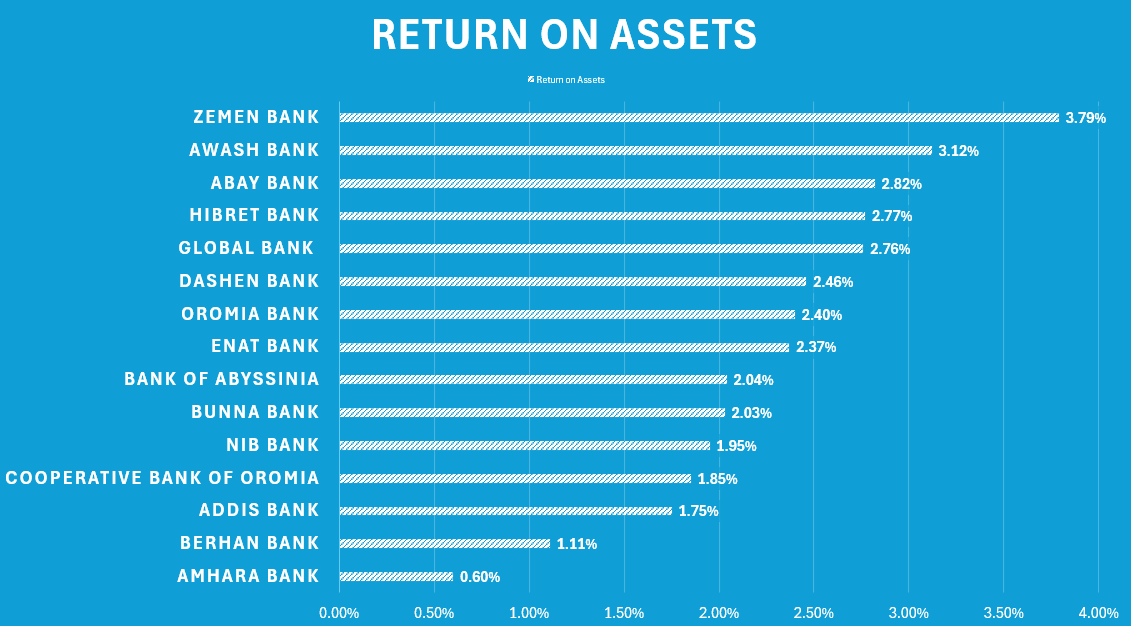

- Return on Assets (ROA)

ROA shows how efficiently a bank uses its assets to generate profit. A higher ROA indicates the bank’s ability to convert its assets into earnings, a crucial factor in capital-intensive sectors like banking.

Chart:

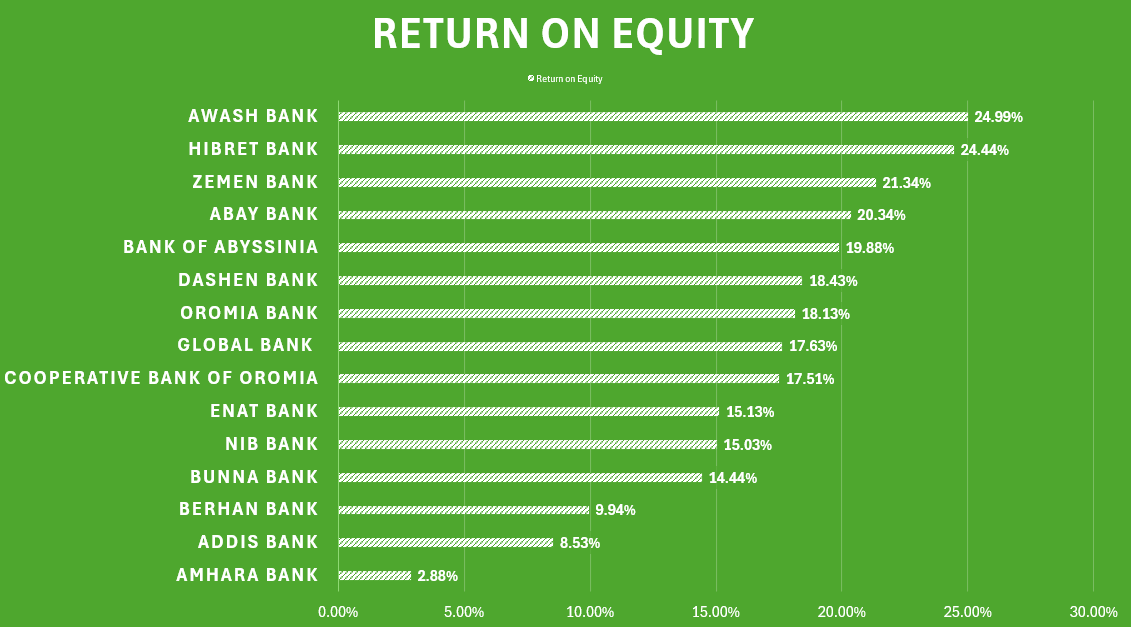

- Return on Equity (ROE)

ROE reflects a bank’s ability to generate profits from shareholders’ equity. Higher ROE means better returns for investors, indicating how efficiently a bank is using its equity capital.

Chart:

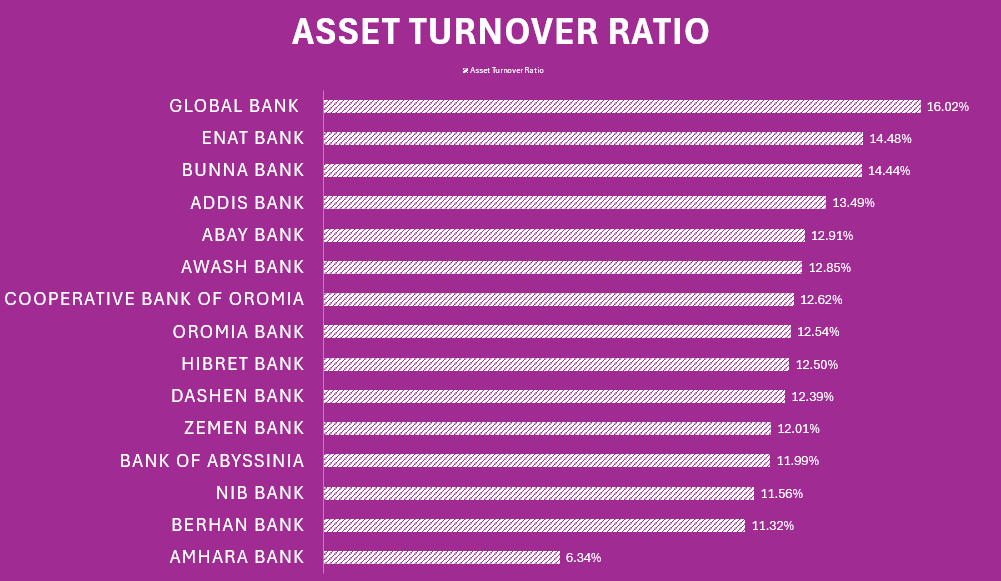

- Asset Turnover Ratio

This metric shows how effectively a bank uses its assets to generate revenue. A higher asset turnover ratio signifies better efficiency in turning assets into revenue.

Chart:

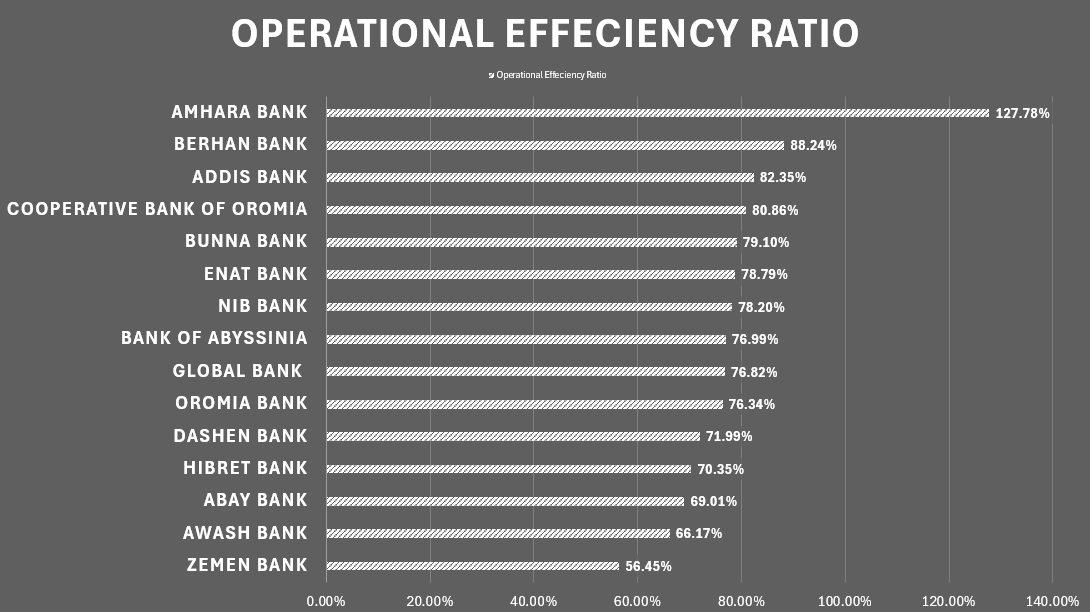

- Operational Efficiency Ratio

This ratio measures how well a bank controls its operating expenses relative to its income. A lower operational efficiency ratio means the bank is more efficient at managing its costs.

Chart:

Ethiopia’s Most Efficient Banks

Based on the analysis of these key financial metrics, we’ve identified four banks that stand out for their overall efficiency:

- Zemen Bank

Zemen Bank has excelled across various metrics, particularly in terms of Return on Assets (ROA) and Operational Efficiency Ratio. Its strategic approach to resource management enables it to convert assets into profit more effectively than its competitors, making it one of Ethiopia’s most efficient banks. - Awash Bank

Awash Bank’s consistent performance, especially in ROE and profitability, highlights its strong ability to generate returns for shareholders while controlling expenses. Its impressive balance between profitability and cost management places it high among the most efficient banks in Ethiopia. - Abay Bank

Abay Bank has shown strong financial efficiency, especially in asset management and cost control. It ranks well in both ROA and the Asset Turnover Ratio, indicating a high degree of efficiency in converting its assets into revenue while maintaining solid profitability. - Hibret Bank

Hibret Bank continues to perform well in terms of ROE and Operational Efficiency Ratio. The bank’s ability to keep operational costs low while delivering solid returns to shareholders makes it one of Ethiopia’s top performers in efficiency.

Why Efficiency Matters for Investors and Customers

For investors, efficiency translates into better returns. Banks that effectively manage their assets, control costs, and maximize profits are more likely to deliver higher returns on investments. For customers, efficient banks tend to offer better interest rates, lower fees, and more reliable services, as they have the financial stability to reinvest in improving their products and services.

Conclusion

As Ethiopia’s banking landscape grows more competitive, efficiency will become an increasingly important measure of success. Zemen, Awash, Abay, and Hibret have proven themselves as leaders in financial efficiency, excelling in areas like asset management, profitability, and cost control. These banks represent the future of the Ethiopian banking industry, offering solid returns for investors and robust services for customers.

By closely monitoring these metrics, stakeholders can gain valuable insights into the long-term potential of Ethiopia’s banking sector.

All data presented in this analysis is sourced from the annual reports of Ethiopian banks for the fiscal year 2022-23.

Leave a Reply