Foreign Banks to Transform Ethiopia’s Banking Sector: Share Premiums Expected to Surge

Ethiopia is on the verge of a banking revolution as foreign banks prepare to enter the market, a move expected to drive share premiums significantly higher. Drawing on lessons from nations like Nigeria and Kenya, where share premiums surged 50% to 150% following foreign bank entry, Ethiopia is poised to experience a similar trend.

The Role of Foreign Ownership Cap

With foreign ownership capped at 49%, demand for shares is anticipated to outpace supply, fueling competition among investors. Analysts predict that share premiums could rise by 50% to 100%, or even more, as foreign players vie for a stake in Ethiopia’s promising financial sector.

Premiums Driven by Bank Size and Stability

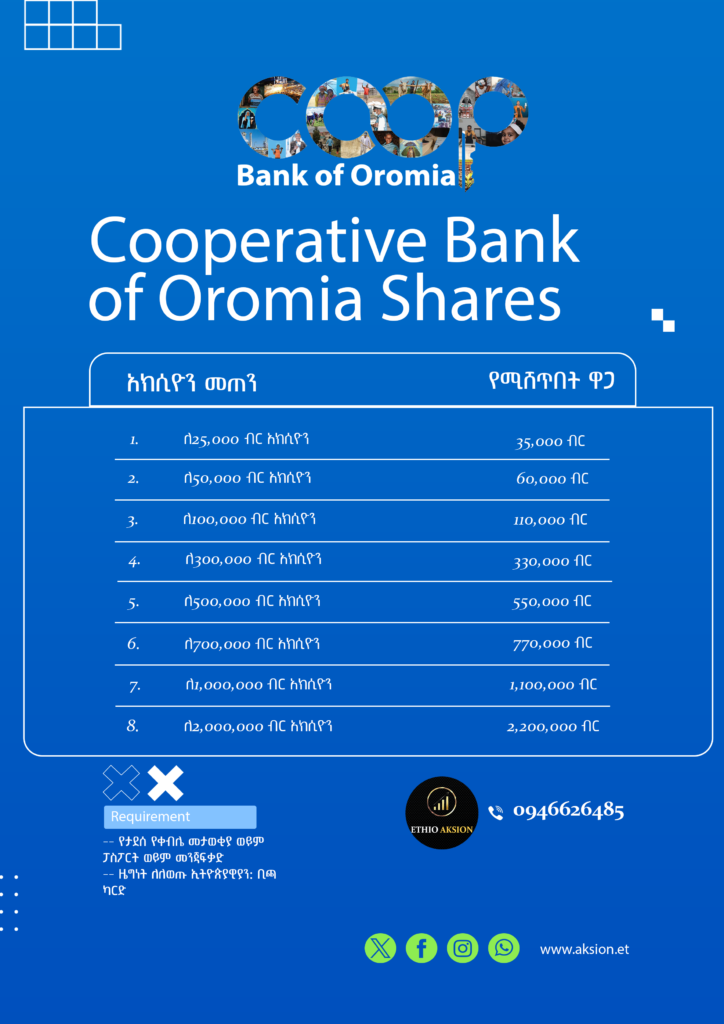

Foreign banks typically prefer well-capitalized and stable institutions for entry, making banks such as Awash Bank, Abyssinia Bank, Dashen Bank, and Coop Oromia highly attractive. These institutions boast strong paid-up capital and financial resilience, positioning them to command premiums exceeding 100%. This trend reflects foreign investors’ priorities of minimizing risks while gaining significant market influence.

Focus on Performance Metrics

Foreign investors also evaluate banks based on financial performance, with profitability, Return on Equity (ROE), and Non-Performing Loan (NPL) ratios playing critical roles. High-performing banks with robust operational efficiency and profitability are expected to lead the premium race. Among these, Zemen Bank stands out with industry-leading metrics, including the best Operational Efficiency Ratio and Profit Margin, making it a strong candidate for investor interest.

Broader Implications for the Market

The influx of foreign banks and capital will likely enhance competition, innovation, and overall sector efficiency. While leading banks will see the most immediate benefits, smaller banks with growth potential may also attract speculative investments, offering diverse opportunities across the sector.

Investor Call to Action

This historic moment presents a lucrative opportunity for investors. As share premiums climb and foreign interest intensifies, securing shares in Ethiopia’s top-performing banks is critical for those aiming to maximize returns.

The financial landscape in Ethiopia is on the cusp of transformation—investors who act swiftly are set to reap the rewards of this monumental shift.

Don’t miss this rare chance to invest in Ethiopia’s banking sector as it undergoes a historic transformation. With foreign banks entering the market and share premiums set to skyrocket, this is your moment to secure shares in leading banks before prices surge beyond reach.

📞 Contact Us Today to purchase shares or for more information:

Phone: +251-946-626485

Website: www.ethiopianbankshare.com

Leave a Reply